Medicare: Parts A and B Explained

Medicare comes in multiple parts and it’s these parts that work together to create a comprehensive healthcare policy. Part A of Medicare is the base component of Medicare. It covers hospitals and is free for anyone that has worked in the US for 10 years or has been married to someone that has worked in the US for 10 years. Along with Part A, most folks get Part B from the government too. Part B is doctor coverage, and by getting Part B it allows you to get more insurance components, more alphabet. Follow along for a deeper dive into what Medicare Parts A and B mean for your health care.

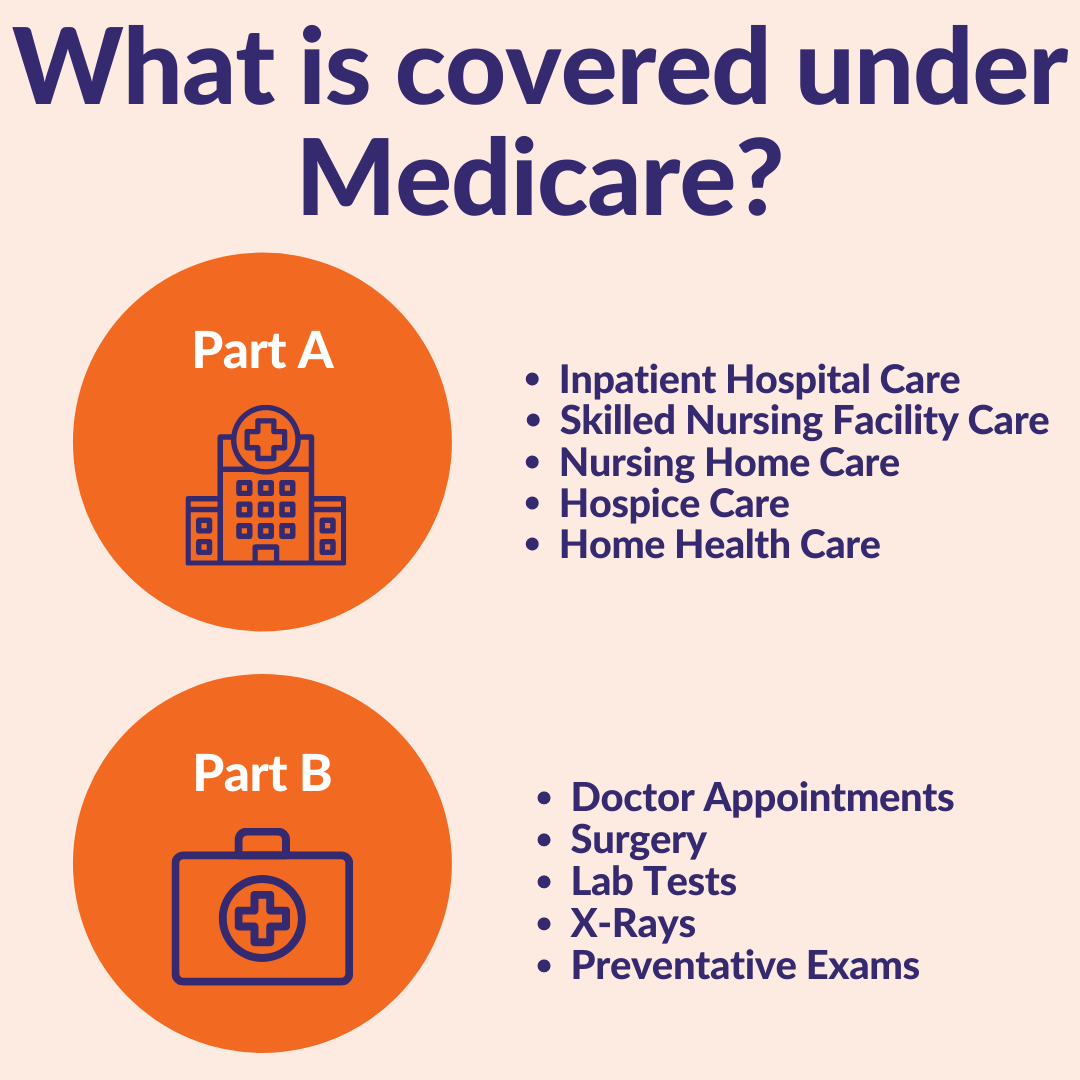

What it Covers

Medicare works differently than insurances available in the under 65 market. Part A does not cover visits to the doctor or prescriptions, but it does cover the following:

Inpatient Hospital Care

Skilled Nursing Facility (SNF) Care

Nursing Home Care

Hospice Care

Home Health Care

How to Apply for Part A

Part A benefits happen the 1st of the month in the month of your 65th birthday. Meaning that if you turn 65 on March 29th then you begin Medicare Part A on March 1st. Part A happens automatically without needing to apply. With that said it is important to verify your information with Social Security to make sure your address and current details are correct so you receive your ID card -- Medicare Claim Card.

Medicare Part B

Part B is the doctor coverage portion of Medicare. Unlike Part A, it starts at a cost of $144 a month and goes up based on your level of annual income. This type of coverage is optional, so if you want it, you have to opt into it. To get the look and feel of your under 65 health insurance, we recommend opting in to Part B, especially because seeing a doctor and having it covered by insurance is crucial as we grow older.

It’s also important to note that if you don’t sign up for Part B when you’re eligible to, that depending on your reason for not enrolling you could be financially penalized with fines when you do enroll.

Enrolling in Medicare doesn’t have to be an intimidating process. If you’re looking to explore your best Medicare options, contact us to get in touch with one of our insurance agents.