Individual vs Group Life Insurance

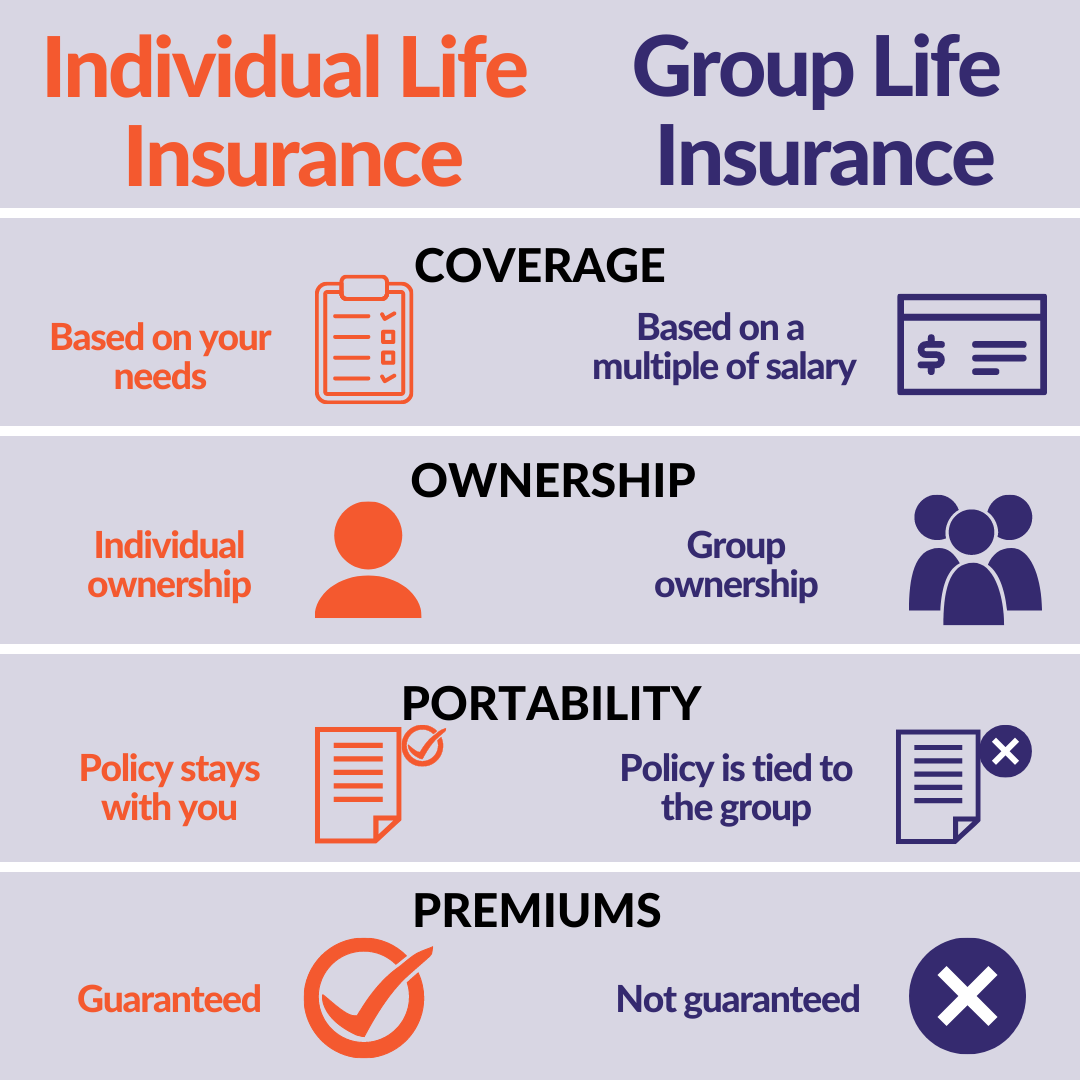

Understanding group life insurance and individual life insurance can be complicated. It is important to know the difference between these two types of life insurance plans, as well as how being furloughed or laid off can affect your group life insurance.

What is individual life insurance?

Individual life insurance is the most common type of life insurance. Your policy belongs to you regardless of your employment status. In order to receive individual life insurance benefits, you must go through an application process, and often a medical exam and underwriting.

What is group life insurance?

Group life insurance is tied to your employment and can be a good option when your employer is paying for it, but it only lasts as long as you are employed there. Your policy is part of a group contract, with a simple application and no exam. Premiums for your group life insurance policy are reviewed annually (or every five years) and can be increased for the whole group.

How does having your employment terminated (even temporarily) affect group life insurance?

Group life insurance, provided through the workplace, is typically offered through the company’s group life plan. If you are furloughed or laid off, you are no longer part of the company’s group life plan and your employer is not responsible for your coverage. In other words, you no longer have access to your group life insurance. With record unemployment rates during this current COVID-19 pandemic, it is important to make sure you have a backup plan in case you lose your life insurance coverage through your employer.

Understanding the basics of individual and group life insurance is essential for protecting yourself and your family. For additional inquiries regarding coverage, rates, and benefits, we are happy to walk you through your options!